(originally posted oct 9/06)

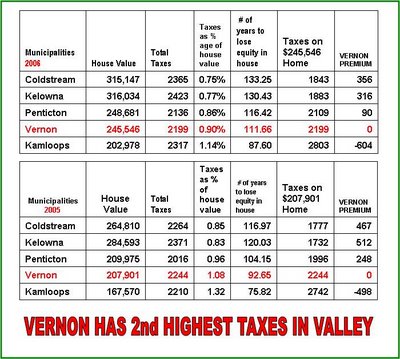

The image below illustrates various ways of comparing the taxes on an average house in each community. I have been assured by the Provincial Statistician that their method of comparing the average house Value was implemented to have the same consistency throughout the provincial numbers. In Vernon's case she says "We took the single family residential assessed value ($2,500,636,780) and divided it by the total single family residential number of occurrences (10,184) to determine the average house. We have calculated it in this manner so that the same application is applied across the province and the figures are more verifiable than previously." (Using Vernon's average house value of 230,072 given on tax notices would NOT change Vernon's tax position in these charts).

$$$$$$$$$$$$$$$$$

ClICK ON IMAGE TO ENLARGE

2 comments:

Is water and sewer etc. included as this is included in some municipalities taxes?

Water and sewer are not included in the Provincial figure I use. they are generally isolated in a column called user fees. If you check the http://www.mcaws.gov.bc.ca/lgd/infra/tax_rates/tax_rates2005.htm which is the 2005 figures you will see this in the Taxes and charges on a representative house. (2006 figures will be posted shortly by Province. )

Post a Comment